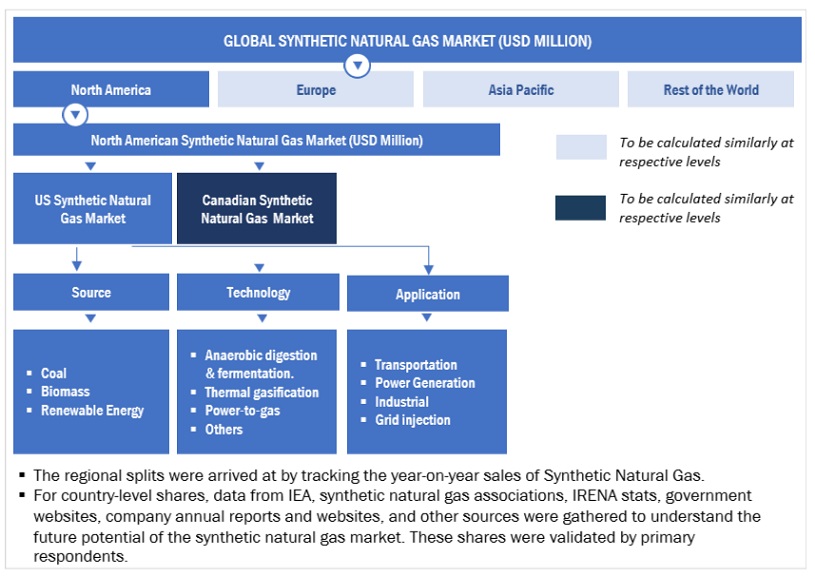

Synthetic Natural Gas Market by Source (Coal, Biomass, Renewable Energy), Technology (Anaerobic Digestion & Fermentation, Thermal Gasification, Power to Gas, Fluidized bed gasifier, Entrained flow gasifier), Application & Region - Global Forecast to 2029

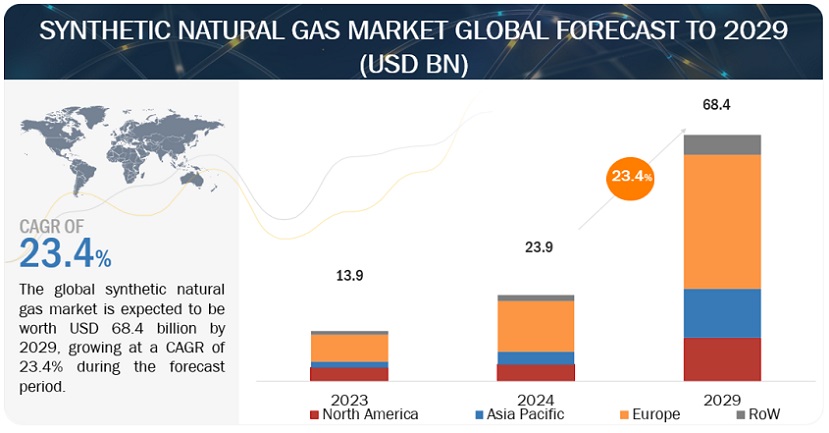

[234 Pages Report] The global synthetic natural gas market is projected to reach USD 68.4 billion by 2029 from an estimated USD 23.9 billion in 2024, at a CAGR of 23.4% during the forecast period. The rise of intermittent renewables necessitates the need for grid balancing and flexibility solutions to match supply with demand. SNG production facilities can be strategically located near renewable energy generation sites, enabling surplus electricity from renewables to be converted into SNG during times of excess generation. This stored energy can then be utilized during peak demand periods or when renewable output is low, thereby enhancing grid stability and resilience.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Synthetic Natural Gas Market Dynamics

Driver: Technological advanacements in Synthetic natural gas Infrastructure

The rising global demand for natural gas, propelled by factors like population growth and industrial expansion, has led to a growing interest in synthetic natural gas (SNG) as a viable solution. SNG, produced through gasification processes using materials such as coal or biomass, offers versatility in sourcing and production. Unlike conventional natural gas, SNG can be synthesized from various feedstocks, providing flexibility in meeting demand. Moreover, SNG presents environmental benefits, with technologies like carbon capture and storage mitigating its carbon footprint. SNG's potential is particularly noteworthy in regions lacking access to conventional natural gas reserves, offering a sustainable energy alternative. The World Bank underscores the role of natural gas in driving industrial growth in developing nations, with its cleaner combustion making it an attractive option for industries like steel and cement manufacturing, especially in light of tightening environmental regulations.

Restraint: Lack of infrastructure in Market

The synthetic natural gas (SNG) market faces significant obstacles due to inadequate infrastructure, inconsistent regulations, and strong competition from traditional energy sources. Regions lacking pipelines and storage facilities, like parts of Africa, struggle to establish the necessary infrastructure for SNG production and distribution. Moreover, varying emissions standards and safety protocols across jurisdictions create uncertainty for investors. Competition from conventional natural gas and renewables further hampers SNG market growth. In regions with abundant natural gas reserves, like the United States, traditional extraction methods offer cost advantages over SNG. Additionally, the decreasing costs of renewable energy technologies, such as solar and wind power, pose a competitive challenge to both natural gas and SNG.

Opportunities: Increased focus on waste-to-energy projects

The increasing focus on waste-to-energy initiatives presents a notable opportunity for the synthetic natural gas (SNG) market, offering a viable pathway to mitigate environmental impact while fulfilling energy needs. Waste-to-energy projects have the potential to utilize diverse waste sources, including landfill gas, municipal solid waste, and agricultural residues, as inputs for SNG production. This not only redirects waste away from landfills but also mitigates greenhouse gas emissions from decomposition, while concurrently generating a valuable source of clean energy. When waste serves as the feedstock for SNG production, the resulting synthetic natural gas can be classified as renewable SNG (RSNG) if the waste source is biogenic. This distinction significantly enhances the sustainability credentials of SNG compared to its production from fossil fuels. For example, in California, facilities specializing in renewable natural gas (RNG) are leveraging landfill gas and sewage biogas to produce environmentally friendly transportation fuel.

Challenges: Leakage of methane

A significant challenge for Synthetic Natural Gas (SNG) to uphold its environmentally friendly reputation lies in methane leakage. Methane, a potent greenhouse gas with over 80 times the short-term warming potential of carbon dioxide, poses a substantial threat to the climate. Even minor leaks during SNG production can release significant amounts of methane, thereby undermining the emissions reductions achieved by substituting SNG for fossil fuels. According to the Natural Resource Defense Council (NRDC), methane is highly effective at trapping heat in the atmosphere, with a warming potential around 30 times greater than that of carbon dioxide over a century. The environmental advantage of SNG hinges on the materials used and the production process employed. If methane leakage is prevalent, it can nullify the lifecycle greenhouse gas benefits that SNG offers compared to conventional natural gas. Leakage incidents can occur at various stages, including production, transportation, and storage of SNG. Therefore, stringent measures are imperative throughout the entire SNG process to mitigate these fugitive methane emissions.

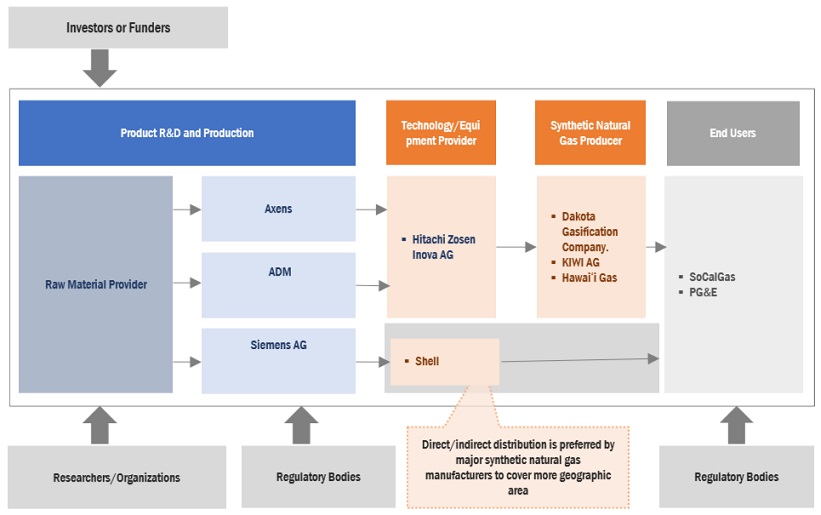

Synthetic Natural Gas market Ecosystem

In this market, prominent companies stand out as well-established and financially stable providers of synthetic natural gas. With years of experience, these companies boast a diverse product portfolio, cutting-edge technologies, and robust global sales and marketing networks. Their proven track record in the industry positions them as reliable and trusted partners for customers seeking synthetic natural gas. These companies have demonstrated their ability to adapt to market dynamics and consistently deliver high-quality products and services, making them leaders in meeting the demands of the energy and power sector. Prominent companies in this market Basin Electric Power Cooperative (US), Air Liquide (France), EnviTec Biogas AG (Germany), Verbio SE (Germany), Kinder Morgan (US).

The thermal gassification segment, by application, is expected to be the largest market during the forecast period.

This report segments the synthetic natural gas market based on application into four categories: anaerobic digestion & fermentation, thermal gasification, power-to-gas and others. The thermal gasification segment is expected to be the largest market during the forecast period. The need for effective waste management solutions, especially for organic waste streams like agricultural residues and municipal solid waste, is driving interest in thermal gasification for SNG production. Converting waste into valuable energy products helps address both energy and waste management challenges.

By Application, Transportation is expected to be the fastest growing segment during the forecast period.

This report segments the synthetic natural gas market based on application into four segments: Transportation, power generation, industrial, and grid injection. The transportation segment is expected to be the fastest-growing segment of the synthetic natural gas and transportation market during the forecast period. Consumer demand for vehicles powered by cleaner fuels such as synthetic natural gas (SNG) is experiencing a significant upsurge due to a growing awareness of the environmental consequences of traditional fossil fuels. With increased access to information about climate change and air pollution, consumers are becoming more conscious of their carbon footprint and are actively seeking greener alternatives for their transportation needs.

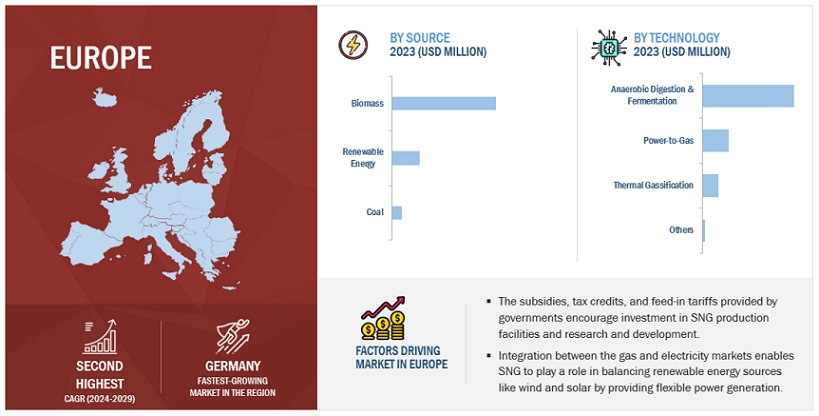

Europe: The largest growing region in the Synthetic Natural Gas market.

Europe is expected to be the largest region in the synthetic natural gas market between 2024–2029. European partnerships with other countries, such as Japan and South Korea, which are also investing heavily in synthetic natural gas technologies, are accelerating the development of global synthetic natural gas supply chain networks.

Key Market Players

The synthetic natural gas market is dominated by a few major players that have a wide regional presence. The major players in the synthetic natural gas market include Basin Electric Power Cooperative (US), Air Liquide (France), EnviTec Biogas AG (Germany), Verbio SE (Germany), Kinder Morgan (US). Between 2020 and 2024, Strategies such as new product launches, contracts, agreements, partnerships, collaborations, acquisitions, and expansions are followed by these companies to capture a larger share of the synthetic natural gas market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

Synthetic natural gas Market by source, technology, application, and Region. |

|

Geographies covered |

North America, Europe, Asia Pacific, and RoW. |

|

Companies covered |

Basin Electric Power Cooperative (US), Air Liquide (France), EnviTec Biogas AG (Germany), Verbio SE (Germany), Kinder Morgan (US), OPAL Fuels (US), TotalEnergies (France), E. ON SE (Germany), Chevron Corporation (US), Waga Energy (France), Ameresco (US), Shell (UK), Naturgy (Spain), Gevo, Inc (US), EDL (Australia), Electrochaea GmbH (Germany), Future Biogas Limited (Canada), PlanET Biogas Group (Germany), AB Holding SPA (Italy), KIWI AG (Germany), Cycle0 (UK), Archaea Energy inc., (US), TURN2X (Germany), Monarch Bioenergy (US) and Uniper SE (Germany). |

This research report categorizes the Synthetic natural gas Market based on source, technology, application and region.

On the basis of Application, the Synthetic natural gas market has been segmented as follows:

- Transportation

- Power generation

- Industrial

- Grid injection

On the basis of Technology, the Synthetic natural gas market has been segmented as follows:

- Anaerobic digestion & fermentation

-

Thermal gasification

- Moving bed gasifier

- Fluidized bed gasifier

- Entrained flow gasifier

- Power-to-gas

- Others

Based on region, the Synthetic natural gas market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW

Recent Developments

- In April 2024, Air Liquide continues to expand its capacities in biomethane, also known as Renewable Natural Gas (RNG) in the U.S., with the construction of two new production units. These units, located in Center Township, Pennsylvania, and Holland Township, Michigan, will treat waste sourced from dairy farms.

- In April 2024, Brightmark RNG Holdings, a joint venture between Chevron USA Inc. and Brightmark, has opened its Eloy Renewable Natural Gas (RNG) center, producing pipeline fuel by capturing methane from dairy operations. Eloy RNG will produce RNG using anaerobic digesters at the Caballero Dairy farm in Arizona.

- In April 2024, AMERESCO, A leading cleantech integrator specializing in energy efficiency and renewable ENERGY, DEVELOPED and construct advanced technology biogas cogeneration facility for the Sacramento Area Sewer District located at the EchoWater Resource Recovery Facility which will cost nearly USD 140 million.

- In March 2024, Electrochaea and Erik Thun AB have signed an agreement to enter negotiations on the off-take of e-methane to be produced by Electrochaea’ s subsidiary BioCAT Roslev Aps in Denmark for usage as maritime fuel in the vessels operated by Erik Thun AB.

Frequently Asked Questions (FAQ):

What is the current size of the synthetic natural gas market?

The current market size of the synthetic natural gas market is USD 68,401.0 million in 2024.

What are the major drivers for the synthetic natural gas market?

Synthetic natural gas is used in various industrial processes, transportations, power generation, and grid injection. Growth in these industries increases the demand for the synthetic natural gas market.

Which is the largest region during the forecasted period in the Synthetic natural gas market?

Asia Pacific is expected to dominate the synthetic natural gas market between 2024–2029, followed by North America and Europe.

Which is the largest segment, by application, during the forecasted period in synthetic natural gas market?

The Power generation segment is expected to be the largest market during the forecast period owing to its relatively mature and cost-effective.

Which is the largest segment, by source, during the forecasted period in the synthetic natural gas market?

Biomass is expected to be the largest market during the forecast period by application. Biomass-derived SNG offers a potential solution for countries seeking to reduce dependence on imported fossil fuels, thereby enhancing energy security. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

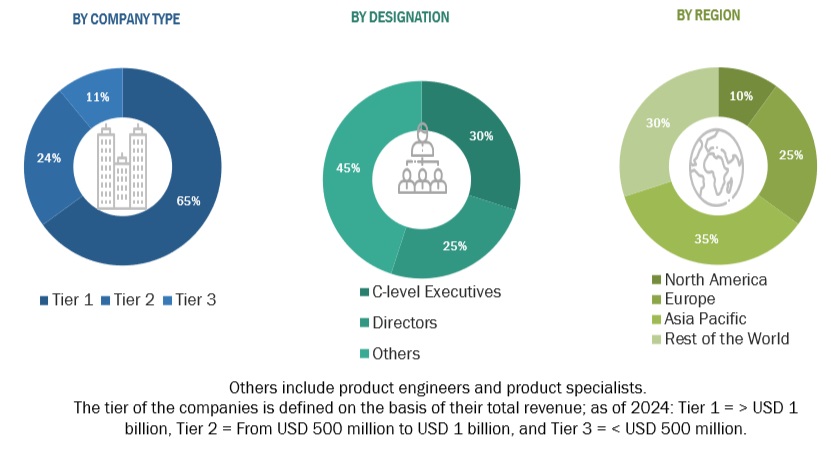

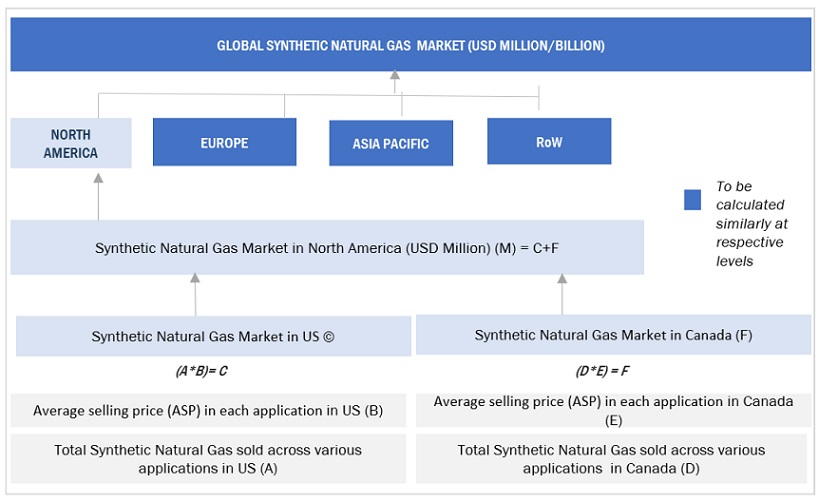

The study involved major activities in estimating the current size of the synthetic natural gas market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the synthetic natural gas market involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg, Factiva, IRENA, International Energy Agency, and Statista Industry Journal, to collect and identify information useful for a technical, market-oriented, and commercial study of the synthetic natural gas market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The synthetic natural gas market comprises several stakeholders, such as synthetic natural gas manufacturers, technology providers, and technical support providers in the supply chain. The demand side of this market is characterized by the rising demand for storage solutions in various applications such as energy, mobility, industrial, and transportation. The supply side is characterized by rising demand for contracts from the industrial sector and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the synthetic natural gas market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share has been determined through primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through both primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Synthetic Natural Gas Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Synthetic Natural Gas Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the total market has been split into several segments and subsegments. Data triangulation and market breakdown processes have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

Synthetic natural gas (SNG) is an artificially created substitute for natural gas, often made through a process called gasification, which transforms solid or liquid carbon-based materials into a methane-rich gas. SNG, is synthetically derived from various feedstocks including coal, biomass, and renewable energy sources, or municipal solid waste, mirrors natural gas in its properties and utility, suitable for purposes ranging from heating to power generation and transportation.

Key Stakeholders

- Synthetic natural gas Dealers and Suppliers

- Research institutes

- Government and Research Organizations

- Power and Energy Associations

- State and National Regulatory Authorities

- Research And Consulting Companies in the Clean Energy Generation Sector

- Organizations, Forums, Alliances, And Associations

- Industrial Authorities and Association

State and National Regulatory Authorities Objectives of the Study

- To define, describe, segment, and forecast the Synthetic natural gas market size, by source, technology, and application, in terms of value.

- To forecast the synthetic natural gas Dealers and Suppliers

- Research institutes

- Government and Research Organizations

- Power and Energy Associations

- State and National Regulatory Authorities

- Research And Consulting Companies in the Clean Energy Generation Sector

- Organizations, Forums, Alliances, And Associations

- Industrial Authorities and Association

- market size, by tank type, and application in terms of volume.

- To forecast the market size across four key regions: North America, Europe, Asia Pacific, and RoW, along with country-level analysis, in terms of value and volume.

- To describe key elements required to manufacture a Synthetic natural gas.

- To provide statistical data for installed Synthetic natural gas for each region and country.

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the market growth.

- To provide the supply chain analysis, trends/disruptions impacting customer business, market mapping, pricing analysis, and regulatory landscape pertaining to Synthetic natural gas market.

- To strategically analyze the ecosystem, standards and regulations, patent analysis, trade analysis, Porter’s five forces, and case studies pertaining to the market under study.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, contributions to the overall market size.

- To analyze opportunities for stakeholders in the Synthetic natural gas market and draw a competitive landscape for market players.

- To benchmark players within the market using the company evaluation matrix, which analyzes market players based on several parameters within the broad categories of business and product strategies.

- To compare the key market players with respect to the market share, product specifications, and applications.

- To strategically profile the key players and comprehensively analyze their market ranking and core competencies.

- To analyze competitive developments in the Synthetic natural gas market, such as contracts, agreements, investments, expansions, product launches, partnerships, joint ventures, and collaborations.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Growth opportunities and latent adjacency in Synthetic Natural Gas Market